When it comes to seeking high returns, investors often look to volatile assets, hoping to capitalize on significant price swings. Two of the most talked-about volatile investment options in recent times are GameStop (GME) and cryptocurrencies. But which one offers the most volatile return on investment? And what are the differences between investing in GME and crypto? Let’s dive into the details.

Understanding Volatility

Volatility refers to the degree of variation in the price of a financial instrument over time. High volatility means the price can change dramatically in a short period, providing both opportunities for high returns and risks of significant losses.

GameStop (GME)

GameStop, a brick-and-mortar video game retailer, became the epicenter of a trading frenzy in early 2021. Driven by retail investors on Reddit’s r/WallStreetBets, GME’s stock price soared from around $20 to an all-time high of $483 in a matter of weeks. The stock’s rapid rise and subsequent falls have made it a poster child for market volatility.

- Historical Volatility: GME’s volatility has been exceptionally high since the short squeeze in early 2021. Its price movements are heavily influenced by social media sentiment, trading volume, and short interest.

- Factors Influencing Volatility: Retail investor sentiment, short interest, earnings reports, and news related to the gaming industry or company-specific developments.

- Investment Horizon: GME is primarily seen as a speculative, short-term investment. The stock’s price can swing wildly in response to market sentiment and news, making it a high-risk, high-reward option.

Cryptocurrencies

Cryptocurrencies, such as Bitcoin and Ethereum, are digital assets that operate on decentralized networks. They are known for their high volatility, influenced by factors ranging from technological advancements to regulatory news and macroeconomic trends.

- Historical Volatility: Cryptocurrencies exhibit significant volatility, with prices capable of moving 10-20% in a single day. Bitcoin, for instance, has experienced multiple boom and bust cycles since its inception in 2009.

- Factors Influencing Volatility: Regulatory developments, market sentiment, technological advancements, macroeconomic trends, and social media influence.

- Investment Horizon: Cryptocurrencies can be suitable for both short-term trading and long-term investment, depending on the specific asset and investor’s risk tolerance. Bitcoin and Ethereum, for instance, are often considered long-term investments due to their market leadership and development ecosystems.

Comparing GME and Crypto Investments

Similarities

- High Volatility: Both GME and cryptocurrencies are known for their high volatility, offering the potential for substantial returns and significant losses.

- Influence of Retail Investors: Retail investors play a significant role in driving the price movements of both GME and certain cryptocurrencies. Social media platforms like Reddit and Twitter can have a profound impact on market sentiment.

- Speculative Nature: Investing in GME and cryptocurrencies is largely speculative. Investors often rely on market sentiment and trends rather than fundamental analysis.

Differences

- Market Fundamentals

- GME: GameStop is a publicly traded company with earnings reports, a business model, and tangible assets. Its stock price can be influenced by company performance, industry trends, and broader market conditions.

- Crypto: Cryptocurrencies, particularly Bitcoin and Ethereum, are decentralized assets with no underlying business performance metrics. Their prices are influenced by technology, adoption rates, regulatory news, and macroeconomic factors.

- Regulation

- GME: As a publicly traded stock, GME is subject to regulatory oversight by bodies like the SEC. Insider trading, market manipulation, and financial reporting are strictly monitored.

- Crypto: The regulatory environment for cryptocurrencies is still evolving. Different countries have varying approaches to crypto regulation, which can lead to significant price volatility.

- Investment Horizon

- GME: Primarily seen as a short-term trading opportunity due to its speculative nature and high volatility.

- Crypto: Offers both short-term trading and long-term investment opportunities. Bitcoin and Ethereum, for instance, are considered long-term investments by many due to their potential for future growth and adoption.

Conclusion

Both GME and cryptocurrencies offer the potential for volatile returns on investment, but they come with different risk profiles and investment considerations. GME’s volatility is driven by retail investor sentiment and short interest, making it a highly speculative short-term play. Cryptocurrencies, while also highly volatile, offer a broader range of investment opportunities, from short-term trading to long-term holding, influenced by technological advancements and macroeconomic trends.

Investors seeking the most volatile returns should consider their risk tolerance, investment horizon, and market understanding before diving into either asset class. Diversifying investments and staying informed about market trends can help mitigate some of the risks associated with these highly volatile assets.

For more insights and detailed analyses on investment opportunities, visit our other articles on coinmrkt.com.

If you enjoyed learning about Roaring Kitty and his incredible journey, there’s so much more to discover on Coinmrkt. Dive into our extensive collection of cryptocurrency and investment blogs to stay informed and ahead of the curve. Here are some articles you might find interesting:

- Bitcoin ETF’s Now Hold $1M Bitcoins: How will this affect the Bitcoin price long-term?

- Next Doge Coin 2024: Which Top Meme Coin Will Replace Doge Coin?

- Top 5 Crypto Exchanges By Volume 2024: Which Exchanges Have The Most Volume?

- Ethereum ETFs could drive ETH price to $10K: How Fast Will it Happen?

- Cryptocurrency Scams: How to Notice Them & Avoid Getting Scammed

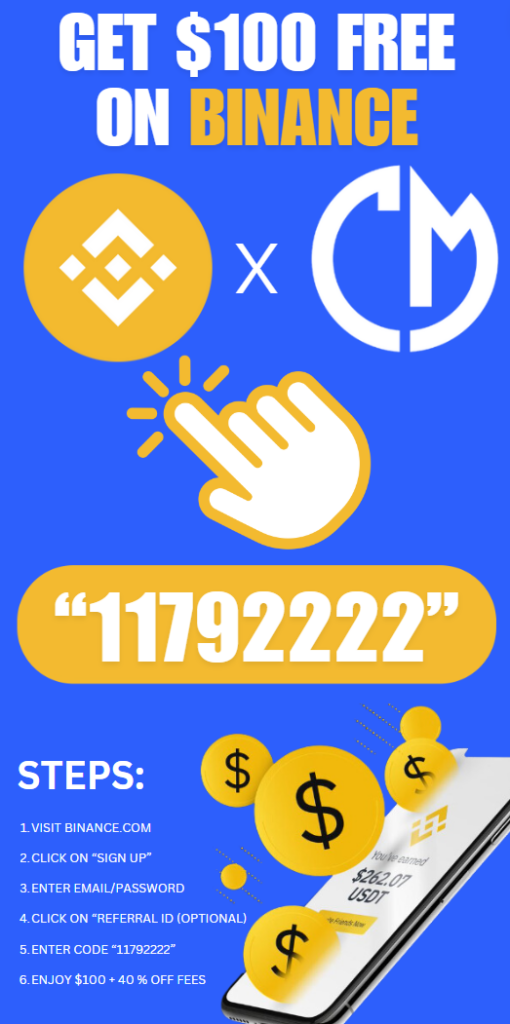

- Binance Referral Code

Coinmrkt is your go-to source for the latest news, analysis, and insights in the world of cryptocurrency and blockchain. Whether you’re a seasoned investor or just starting, our comprehensive guides and expert articles will help you navigate the exciting and often volatile crypto market. Stay informed, stay ahead, and make smart investment decisions with Coinmrkt.