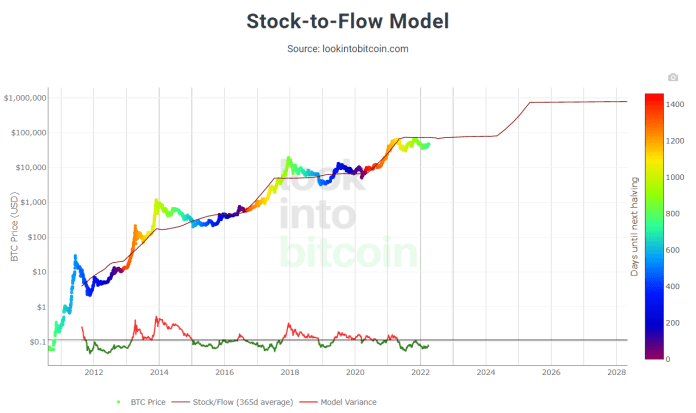

Introduction to the Stock-to-Flow (S2F) Model

The Stock-to-Flow (S2F) model, developed by the anonymous analyst PlanB, has garnered significant attention in the cryptocurrency community. The model predicts the price of Bitcoin based on its scarcity, drawing comparisons to precious metals like gold and silver. The core principle is that the scarcity of an asset, measured by its stock-to-flow ratio, directly impacts its price.

Understanding the S2F Model

- Stock-to-Flow Ratio: The stock is the total existing supply of Bitcoin, while the flow is the annual production (or new Bitcoins mined). For Bitcoin, this ratio increases after each halving event, which occurs approximately every four years, reducing the block reward for miners by half.

- Model Formula: The S2F model is expressed as:Price=a⋅(Stock-to-Flow)b\text{Price} = a \cdot (\text{Stock-to-Flow})^bPrice=a⋅(Stock-to-Flow)bwhere aaa and bbb are constants derived from historical data.

Historical Performance of the S2F Model

PlanB’s S2F model has been remarkably accurate in predicting Bitcoin’s price movements over the years. Notably:

- Pre-2017 Bull Run: The model accurately predicted the price surge to nearly $20,000.

- Post-2017 Bear Market: It also forecasted the subsequent correction and stabilization phases.

- 2020-2021 Bull Run: The model anticipated the sharp increase in Bitcoin’s price during this period, where Bitcoin reached new all-time highs.

Criticisms and Limitations

- Overemphasis on Scarcity: Critics argue that the S2F model overemphasizes Bitcoin’s scarcity while neglecting other crucial factors like market demand, regulatory developments, technological advancements, and macroeconomic conditions.

- Assumption of Linear Progression: The model assumes a linear progression in price increases, which may not account for sudden market shifts or black swan events.

- Market Sentiment: Human behavior and market sentiment play a significant role in Bitcoin’s price movements, aspects that are challenging to quantify within the S2F framework.

Factors Influencing Bitcoin’s Price Beyond S2F

- Regulatory Environment: Regulatory decisions across different jurisdictions significantly impact Bitcoin’s price. Positive regulation can spur investment, while restrictive measures can lead to price drops.

- Institutional Adoption: Increased adoption by institutional investors can drive up demand, as seen with companies like Tesla and MicroStrategy adding Bitcoin to their balance sheets.

- Technological Developments: Advances in Bitcoin’s infrastructure, such as the Lightning Network, can enhance its utility and adoption, positively influencing its price.

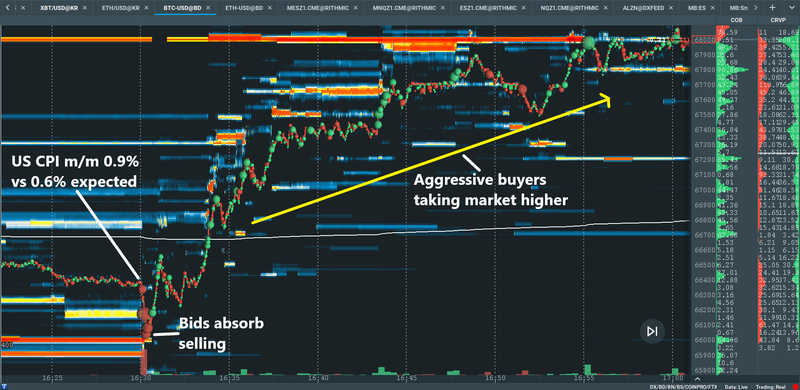

- Macroeconomic Trends: Economic factors like inflation, monetary policies, and global economic stability also play a crucial role. Bitcoin is often seen as a hedge against inflation, attracting investors during times of economic uncertainty.

Future Predictions and Considerations

- PlanB’s Predictions: According to PlanB’s S2F model, Bitcoin is expected to reach $100,000 and potentially higher, with some iterations of the model projecting prices above $1 million in the longer term.

- Market Validation: While the S2F model has its critics, its historical accuracy cannot be ignored. Many investors use it as one of several tools for making informed decisions.

- Balanced Approach: Investors should consider the S2F model alongside other analytical tools and market indicators to form a comprehensive view of Bitcoin’s potential.

Conclusion

PlanB’s Stock-to-Flow model has proven to be a valuable tool in predicting Bitcoin’s price, leveraging the concept of scarcity to explain its value. However, it’s essential to approach it with a balanced perspective, considering other market factors and potential limitations. While the model provides a framework for understanding Bitcoin’s potential price trajectory, the ever-evolving nature of the cryptocurrency market necessitates a multifaceted approach to investment and analysis.

By staying informed and considering various models and market indicators, investors can better navigate the volatile yet promising world of Bitcoin and cryptocurrency investments.

If you’re interested in diving deeper into Bitcoin’s potential and the various models predicting its future, check out some of our detailed analyses on Bitcoin’s Market Trends. For a broader understanding of cryptocurrency market dynamics, our comprehensive guide on Crypto Investment Strategies offers valuable insights. Additionally, our blog post on Regulatory Impacts on Cryptocurrency explores how government regulations can influence the crypto market, providing a well-rounded perspective for investors.