Choosing the right cryptocurrency exchange can be a daunting task, especially with the multitude of options available today. Two of the most prominent names in the crypto trading world are Binance and Bybit. Both exchanges offer robust features and cater to different trading needs, but they also have their unique strengths and weaknesses. In this comprehensive comparison, we will delve into the key differences between Binance and Bybit in 2024, helping you determine which one is the best fit for your trading requirements.

Overview of Binance and Bybit

Binance:

- Established: 2017

- Headquarters: Cayman Islands (originally China)

- User Base: Over 100 million

- Trading Volume: One of the highest in the world

- Core Features: Spot trading, futures, margin trading, staking, savings, crypto loans, and more

Bybit:

- Established: 2018

- Headquarters: Singapore

- User Base: Over 2 million

- Trading Volume: Significant, especially in derivatives

- Core Features: Derivatives trading, spot trading, staking, dual asset investment, and more

Key Differences Between Binance and Bybit

1. Trading Options and Variety

Binance:

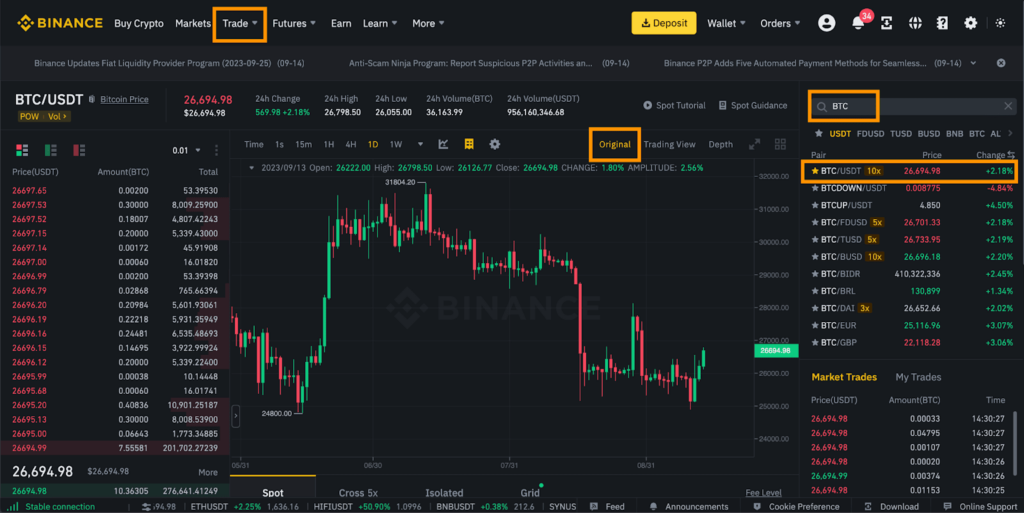

- Spot Trading: Offers a vast array of cryptocurrencies for spot trading.

- Futures and Margin Trading: Extensive futures trading with multiple pairs and leverage options.

- Staking and Savings: Users can stake various cryptocurrencies or earn interest through savings products.

- NFT Marketplace: Binance provides a platform for buying, selling, and creating NFTs.

- Launchpad: A platform for new crypto projects to launch their tokens.

Bybit:

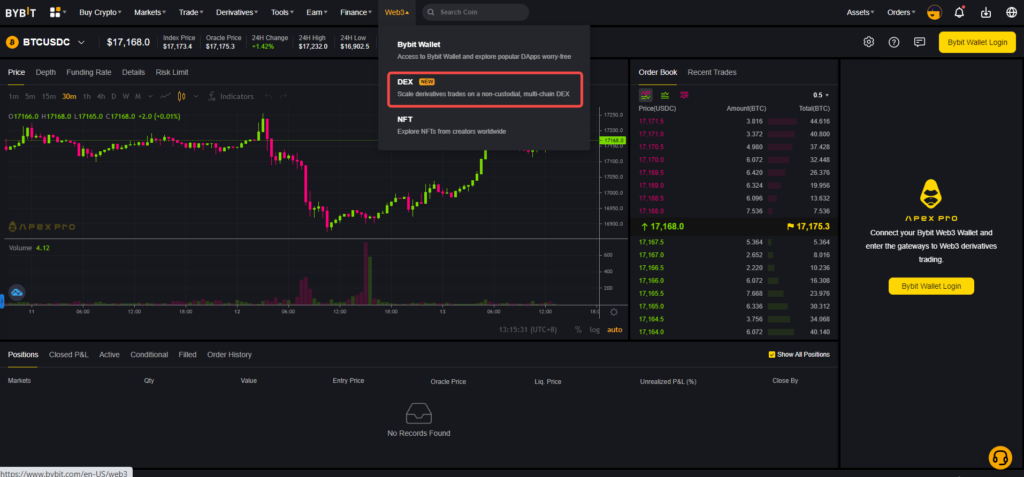

- Derivatives Trading: Focuses heavily on derivatives, offering perpetual contracts and futures with up to 100x leverage.

- Spot Trading: Has expanded its spot trading options, though it’s not as extensive as Binance’s.

- Dual Asset Investment: Allows users to invest in a dual-asset format to maximize returns.

- Bybit Earn: Features various earning opportunities like staking and liquidity mining.

Verdict: If you are looking for a wide variety of trading options and features, Binance is the more comprehensive platform. However, if your primary interest is derivatives trading, Bybit’s focused offerings might be more appealing.

2. User Interface and Experience

Binance:

- Interface: Offers both a basic and an advanced interface, catering to beginners and professional traders.

- Mobile App: Highly functional and user-friendly, providing access to all trading features.

- Learning Curve: Due to its extensive features, it can be overwhelming for new users.

Bybit:

- Interface: Clean and intuitive, designed specifically for derivatives trading.

- Mobile App: Well-optimized for derivatives trading, though with fewer features compared to Binance.

- User Experience: Simplified experience focused on trading efficiency.

Verdict: Bybit’s interface is more streamlined for derivatives traders, making it easier for users focused on this aspect. Binance, while more comprehensive, might be more challenging for beginners to navigate initially.

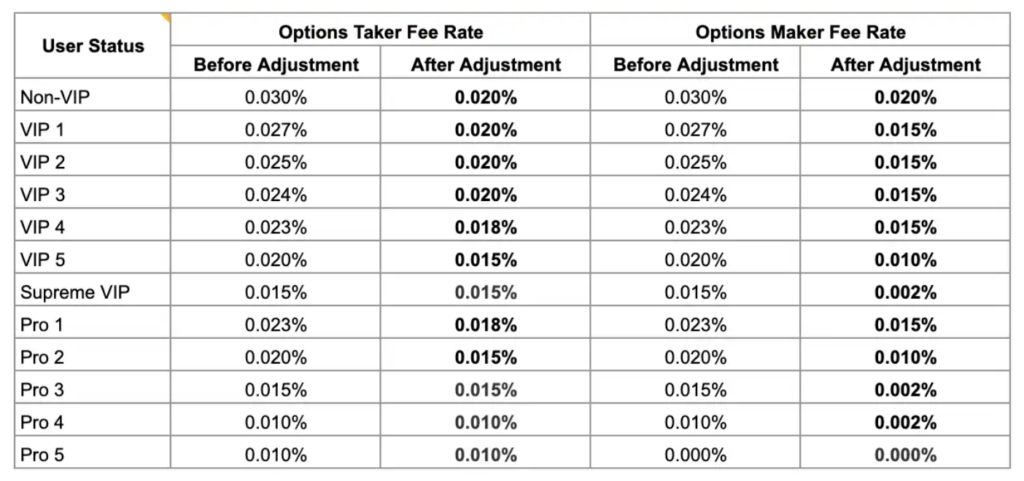

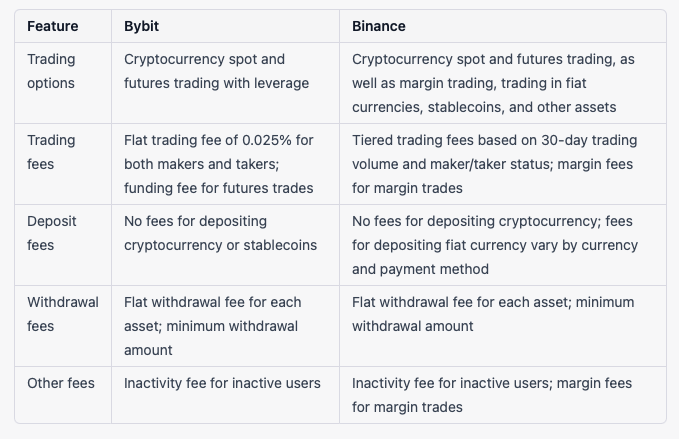

3. Fees and Costs

Binance:

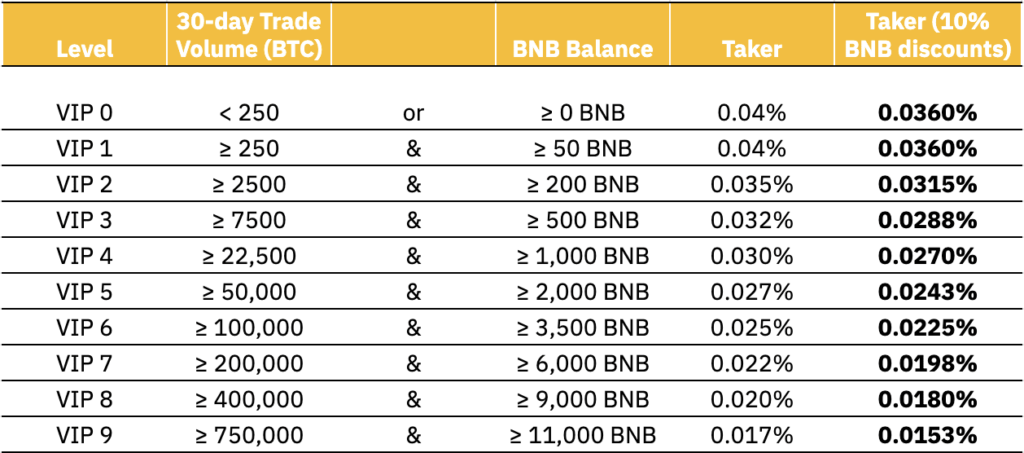

- Spot Trading Fees: Starts at 0.1% per trade, with discounts available for high-volume traders and those using BNB (Binance Coin).

- Futures Trading Fees: Maker fee of 0.02% and taker fee of 0.04%, with potential discounts.

- Other Costs: Withdrawal fees vary depending on the cryptocurrency.

Bybit:

- Derivatives Trading Fees: Maker fee of -0.025% (rebate) and taker fee of 0.075%.

- Spot Trading Fees: Starts at 0.1% per trade.

- Other Costs: Competitive withdrawal fees.

Verdict: Bybit offers a rebate for maker trades in derivatives, which can be advantageous for high-frequency traders. However, Binance’s fee structure provides flexibility with potential discounts, making it cost-effective for a broader range of trading activities.

4. Security

Binance:

- Security Measures: Multi-tier and multi-cluster system architecture, SAFU (Secure Asset Fund for Users) to protect users’ funds in extreme cases.

- Incidents: Experienced a significant hack in 2019 but compensated users through SAFU.

Bybit:

- Security Measures: Multi-signature cold wallets, advanced risk management systems, and constant security audits.

- Incidents: No major security breaches reported.

Verdict: Both exchanges take security seriously, but Bybit’s lack of major incidents might give it an edge in terms of perceived reliability.

5. Customer Support

Binance:

- Support Channels: 24/7 live chat, email support, extensive help center with FAQs and tutorials.

- Community Support: Active community forums and social media presence.

Bybit:

- Support Channels: 24/7 live chat, email support, detailed help center, and educational resources.

- Community Support: Strong presence on social media and active community engagement.

Verdict: Both platforms offer robust customer support, but Binance’s larger user base means it has a more extensive community for peer support.

6. Regulatory Compliance

Binance:

- Regulatory Issues: Faces scrutiny and regulatory challenges in multiple countries, resulting in restrictions on certain services.

- Compliance Efforts: Working towards regulatory compliance in various jurisdictions but still facing hurdles.

Bybit:

- Regulatory Issues: Generally fewer regulatory challenges compared to Binance.

- Compliance Efforts: Continues to enhance its compliance measures to align with global standards.

Verdict: Bybit seems to have a smoother regulatory path currently, making it potentially more stable in terms of regulatory compliance.

Which One is Best for You?

For Beginners:

- Binance: Offers a wide range of features and educational resources, making it a good starting point despite its complexity.

- Bybit: Simpler interface, but primarily suited for those interested in derivatives.

For Advanced Traders:

- Binance: Extensive trading options, including futures, margin, and spot trading, along with advanced tools.

- Bybit: Superior for high-leverage derivatives trading with competitive fees and efficient execution.

For Cost-Conscious Traders:

- Binance: Offers various discounts and a low-fee structure for different trading activities.

- Bybit: Attractive fee rebates for makers in derivatives trading.

For Security-Conscious Traders:

- Both: Both exchanges are highly secure, but Bybit’s lack of major security incidents may give it a slight edge.

Conclusion

In the ever-evolving landscape of cryptocurrency trading, both Binance and Bybit stand out as top-tier exchanges, each with its distinct advantages. Binance offers a comprehensive suite of features suitable for a wide range of trading activities, making it ideal for those looking for a one-stop-shop. Bybit, on the other hand, excels in derivatives trading with a streamlined user experience and competitive fees, making it a favorite among professional traders.

Ultimately, the best choice depends on your trading needs, experience level, and priorities. Whether you prefer the broad capabilities of Binance or the focused efficiency of Bybit, both platforms provide robust solutions for cryptocurrency trading in 2024.

If you enjoyed learning about the top crypto by volumes, there’s so much more to discover on Coinmrkt. Dive into our extensive collection of cryptocurrency and investment blogs to stay informed and ahead of the curve. Here are some articles you might find interesting:

- Bitcoin ETF’s Now Hold $1M Bitcoins: How will this affect the Bitcoin price long-term?

- Next Doge Coin 2024: Which Top Meme Coin Will Replace Doge Coin?

- Top 5 Crypto Exchanges By Volume 2024: Which Exchanges Have The Most Volume?

- Ethereum ETFs could drive ETH price to $10K: How Fast Will it Happen?

- Cryptocurrency Scams: How to Notice Them & Avoid Getting Scammed

- Binance Referral Code

Coinmrkt is your go-to source for the latest news, analysis, and insights in the world of cryptocurrency and blockchain. Whether you’re a seasoned investor or just starting, our comprehensive guides and expert articles will help you navigate the exciting and often volatile crypto market. Stay informed, stay ahead, and make smart investment decisions with Coinmrkt.