Investing in cryptocurrency can seem daunting, especially if you don’t have a lot of money to start with. However, with careful planning and smart strategies, you can begin your crypto investment journey even on a small budget. This guide will walk you through everything you need to know to get started.

Understanding Cryptocurrency

What is Cryptocurrency?

Cryptocurrency is a digital or virtual form of money that uses cryptography for security. Unlike traditional currencies, cryptocurrencies operate on a technology called blockchain, which is a decentralized system that records transactions across many computers.

Why Invest in Cryptocurrency?

Cryptocurrencies offer several advantages, including potential high returns, diversification of your investment portfolio, and the ability to participate in innovative financial systems like decentralized finance (DeFi). However, they also come with risks such as high volatility and regulatory uncertainty.

Getting Started: Steps to Invest with Little Money

Step 1: Educate Yourself

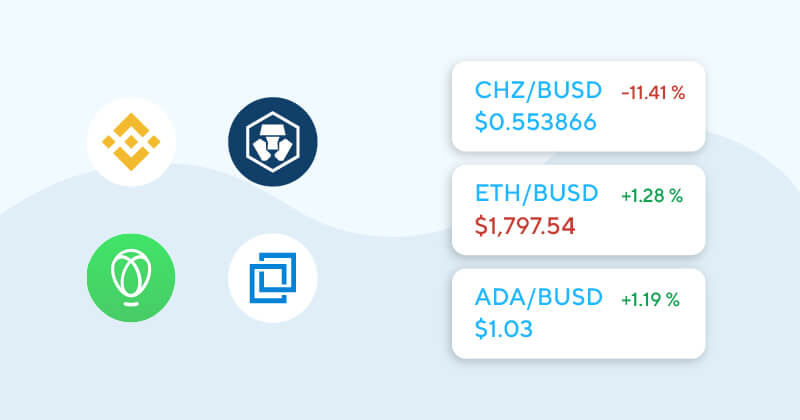

Before diving into the world of cryptocurrency, it’s crucial to understand the basics. Research different cryptocurrencies, how they work, and their potential risks and rewards. Websites like CoinMarketCap and CryptoCompare offer valuable insights and data on various digital assets.

Step 2: Choose the Right Exchange

To buy and sell cryptocurrencies, you’ll need to use a cryptocurrency exchange. Some of the popular exchanges include:

- Coinbase: User-friendly and great for beginners.

- Binance: Offers a wide range of cryptocurrencies and low fees.

- Kraken: Known for its security and robust trading features.

Make sure to choose an exchange that suits your needs, has a good reputation, and offers low transaction fees.

Step 3: Create a Budget

Determine how much money you can afford to invest. Start small to minimize risk. Even $10 or $20 can be enough to get started. Remember, never invest more than you can afford to lose.

Step 4: Diversify Your Investments

Diversification is key to managing risk. Instead of putting all your money into one cryptocurrency, spread your investment across multiple assets. For example, you might invest in Bitcoin, Ethereum, and a few promising altcoins.

Step 5: Use Dollar-Cost Averaging (DCA)

Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of the cryptocurrency’s price. This strategy reduces the impact of volatility and lowers the risk of making large investments at the wrong time.

Affordable Investment Strategies

1. Investing in Fractional Shares

Many exchanges allow you to buy fractional shares of cryptocurrencies. This means you can own a piece of Bitcoin or any other high-priced coin without needing to buy a whole unit.

2. Participating in Airdrops and Giveaways

Cryptocurrency projects often distribute free tokens to promote their platform. Participating in these airdrops and giveaways can be a way to acquire crypto without spending any money.

3. Staking and Earning Interest

Some cryptocurrencies offer staking, where you can earn rewards by holding and validating transactions on the network. Additionally, platforms like BlockFi and Celsius allow you to earn interest on your crypto holdings.

4. Using Cashback Rewards

Some services offer cashback in cryptocurrency for everyday purchases. For example, the Fold app provides Bitcoin rewards for shopping at various retailers.

Staying Safe and Secure

Secure Your Investments

Use strong, unique passwords for your exchange accounts and enable two-factor authentication (2FA). Consider using a hardware wallet for added security.

Avoid Scams

Be wary of phishing attempts, fake websites, and too-good-to-be-true offers. Always verify the authenticity of any crypto-related service before investing.

Stay Informed

Follow trusted news sources and communities to stay updated on market trends and developments. Websites like CoinDesk and CryptoSlate provide regular news and analysis.

Conclusion

Starting with a small budget doesn’t mean you can’t participate in the exciting world of cryptocurrency investing. By educating yourself, choosing the right platforms, and employing smart investment strategies, you can gradually build your crypto portfolio. Remember to stay cautious, diversify your investments, and secure your assets to make the most of your cryptocurrency journey.

Investing in cryptocurrency is a long-term game, and patience, along with continuous learning, will be your best allies. Happy investing!

If you enjoyed learning about Roaring Kitty and his incredible journey, there’s so much more to discover on Coinmrkt. Dive into our extensive collection of cryptocurrency and investment blogs to stay informed and ahead of the curve. Here are some articles you might find interesting:

- Bitcoin ETF’s Now Hold $1M Bitcoins: How will this affect the Bitcoin price long-term?

- Next Doge Coin 2024: Which Top Meme Coin Will Replace Doge Coin?

- Top 5 Crypto Exchanges By Volume 2024: Which Exchanges Have The Most Volume?

- Ethereum ETFs could drive ETH price to $10K: How Fast Will it Happen?

- Cryptocurrency Scams: How to Notice Them & Avoid Getting Scammed

- Binance Referral Code

Coinmrkt is your go-to source for the latest news, analysis, and insights in the world of cryptocurrency and blockchain. Whether you’re a seasoned investor or just starting, our comprehensive guides and expert articles will help you navigate the exciting and often volatile crypto market. Stay informed, stay ahead, and make smart investment decisions with Coinmrkt.